KfW support

Economic effects and measures for companies

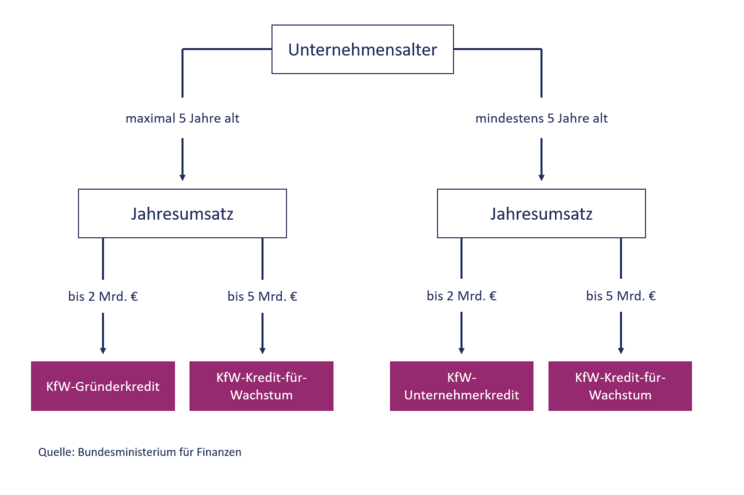

The Federal Ministry for Economic Affairs and Energy (Bundesministerium für Wirtschaft und Energie – BMWi) has launched a three-level support plan. In addition to a support programme for companies on the market longer and less than five years, a Special Programme is currently being set up. To implement the package of measures agreed to mitigate the impact of the coronavirus, the KfW will ensure the short-term liquidity of companies with a significant increase in risk assumption by KfW, fully secured by a federal guarantee.

Note:

Assistance from support programmes is applied for and paid out via the firm’s bank. Please maintain close contact with your firm’s bank. We would be happy to help you in this regard.

Here you can find a preparation guide provided by the KFW. You can prepare for the interview with your bank by filling out this questionnaire.

The following is a brief overview of the programmes

Companies on the market for longer than five years

KfW Entrepreneur Loan (037/047)

When you apply for a loan for investments and working capital, KfW assumes part of your bank’s risk.

- Up to 80% of the risk is assumed for large companies (037)

- Up to 90% of the risk is assumed for small and medium-sized enterprises

You can apply for up to EUR 1 billion per company group. The loan amount is limited to a maximum of

- 25% of the annual turnover in 2019 or

- double the wage costs in 2019 or

- the current financing requirements for the next 18 months for small and medium-sized enterprises or 12 months for large companies, or

- 50% of your company’s total debt in the case of loans exceeding EUR 25 million.

KfW Loan for growth (290)

- Temporary extension to general corporate financing including working capital by way of syndicate financing (previously limited to investments in innovation and digitalisation)

- Increased turnover limit for companies entitled to apply from EUR 2 billion to EUR 5 billion.

- The previous limitation to investment in innovation and digitalisation no longer applies.

- Increased proportionate risk assumption up to 70%. This facilitates the access of medium-sized and larger companies to individually structured, tailored syndicate financing

- The participation of KfW remains pari pasu with market conditions. This means that the economic conditions are provided by the financing partner and assumed by KfW.

Young companies on the market for less than five years

ERP Start-Up Loan – Universal (073/074/075/076)

If your company has been active on the market for at least three years or has two annual financial statements, you can apply for a loan for investments and working capital. KfW assumes part of your bank’s risk. This increases your chances of getting a loan commitment.

- Up to 80% of the risk is assumed for large companies (075)

- Up to 90% of the risk is assumed for small and medium-sized enterprises (076)

You can apply for up to EUR 1 billion per company group. The loan amount is limited to a maximum of

- 25% of the annual turnover in 2019 or

- double the wage costs in 2019 or

- the current financing requirements for the next 18 months for small and medium-sized enterprises or 12 months for large companies, or

- 50% of your company’s total debt in the case of loans exceeding EUR 25 million.

Direct participation for syndicate financing (855)

KfW participates in syndicate financing for investments and working capital for medium-sized enterprises and large companies. In this case KfW assumes up to 80% of the risk, but no more than 50% of the total debt. This increases your chances of getting individually structured and tailored syndicate financing.

The KfW risk share amounts to at least EUR 25 million and is limited to

- 25% of the annual turnover in 2019 or

- double the wage costs in 2019 or

- the current financing requirements for the next 12 months.

Optionally, all banks participating in the syndicate can be refinanced by KfW.

- million → enhanced credit check by firm’s bank

- Loans of more than 10 million → two checks: one by the firm’s bank and one by KfW

A commitment and payment is technically possible from 14 April at the latest. Your bank might pre-finance the amount.

KfW is offering banks and companies the following transitional arrangement from 23 March 2020 to cover acute liquidity needs of companies:

- Loan applications can be submitted to KfW via the support portal (Förderportal) or the web service (access by the banks) for the current programme of loans stored there. You can select the programme terms described above on the “Ergänzende Angaben Sondermaßnahme Corona-Hilfe” (“Supplementary information on special measure for coronavirus aid”) form and upload it together with the risk assessment documentation.

- Once the risk assessment has been completed and a positive loan decision issued, KfW will formally return the application to you and at the same time send you a binding commitment without a payment offer. This entitles you to submit the same application again within one month of the official start of the programme extensions. If this matches the initial application, KfW will make a formal commitment without a new risk assessment, so that it can be accessed immediately.

Follow us on